Impact of Latest Round of HDB Cooling Measures August 2024

- Wilson Ang

- Aug 20, 2024

- 2 min read

One day after Prime Minister Lawrence Wong shared that "We will always keep public housing in Singapore affordable for you!", the Ministry of National Development announced a fourth round of property cooling measures since December 2021 on 19th August 2024 in a move to cool the HDB resale market.

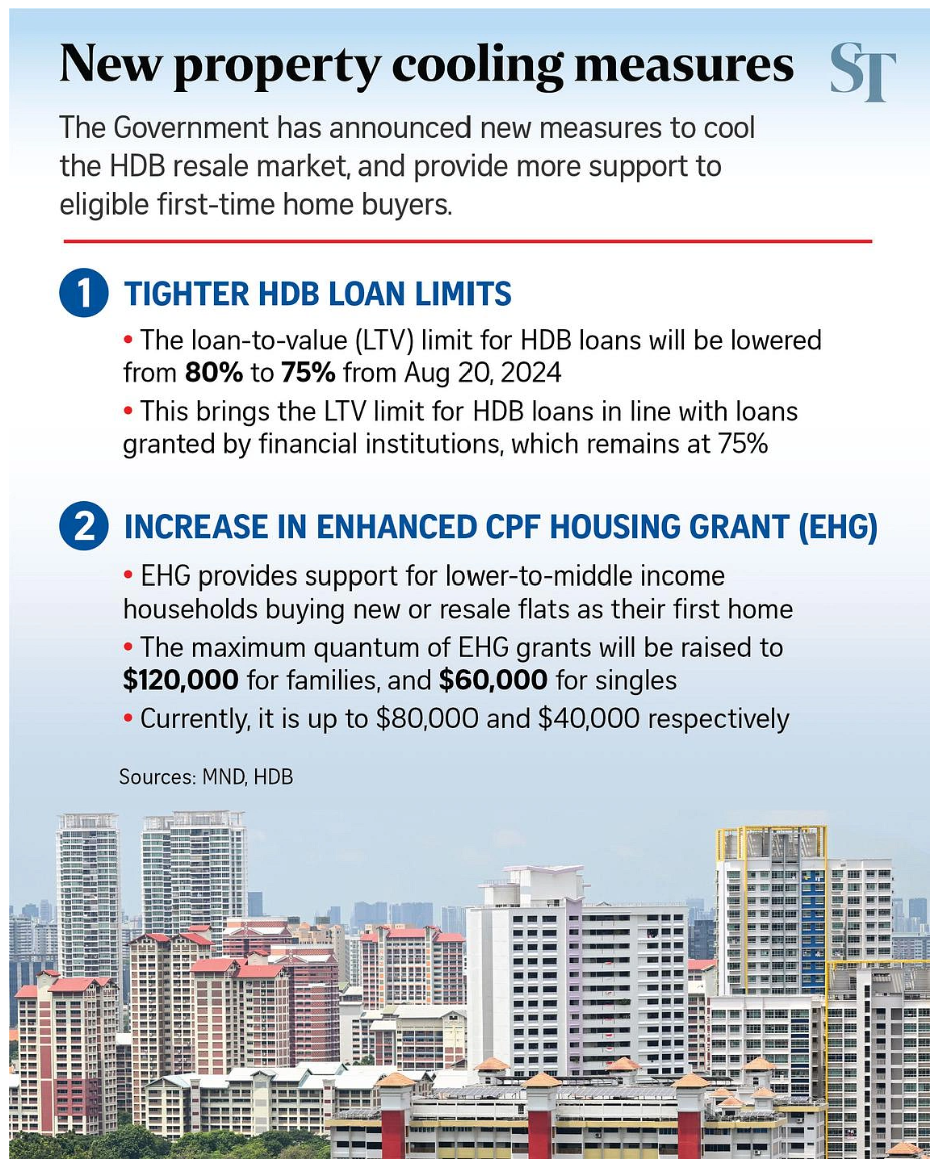

The two measures announced were 1. tighter HDB loan limits from 80% to 75%. 2 Increase in Enhanced CPF Housing Grant to support lower and middle income households buying their first homes.

What are the possible impacts of this latest round of cooling measures, especially the lowered LTV for HDB loans? Let's explore the impact of lowered HDB loan to value ratios in the past. This is the third time that loan to value limit for HDB loans was lowered. This was last introduced on 16th December 2021 where HDB LTV was lowered from 90% to 85%, followed by another 5% decrease in September 2022. Looking at the data chart below, based on the last 2 rounds of reduced LTV for HDB loans, prices experienced a reduced increase from +12% in 2021 to +9% in 2022 and +6% in 2023

What we need to note is that these reduced LTV were introduced during Covid period where there was a supply crunch for new BTOs and buyers were leaning towards the HDB resale market.

Today, HDB has done a good job in ramping up BTO supply, which helps to regulate any pent up demand, hence today's immediate demand for resale HDB may not be as vibrant as 2022.

Having said that, there is also a new group of buyers in today's market - private property owners with cash, waiting for their 15 month wait out period, looking to downgrade into HDBs. This adds new demand into today's resale HDB market, which was not existent in 2022/23.

Looking at the past trend, one should expect the rate of increase for HDB resale prices to taper down further in the months ahead.

For the increase in Enhanced CPF Housing Grant, the additional $40,000 and $20,000 for families and singles respectively is a welcome boost for first time home buyers. Given that the pool of buyers eligible for the maximum grant is not mass market, the impact of this measure may not have a significant impact on resale prices. What do you think about the latest cooling measures for the HDB market?

Hi, I am Wilson😄. Leveraging on my experiences and passion in Real Estate Investing, I am on a mission to guide and empower 💯 individuals each year to embark on their journey🚀to building their property asset portfolios📈. If you think I can help you, I am open to a non obligatory chat to share ideas.💡

Source: https://www.straitstimes.com/singapore/housing/new-property-cooling-measure-to-tighten-hdb-loan-limits-larger-grants-for-lower-income-flat-buyers

Comments