Resale vs New Launch Condos: Should I buy The Chuan Park or Goldenhill Park Condo ?

- Wilson Ang

- Sep 18, 2024

- 3 min read

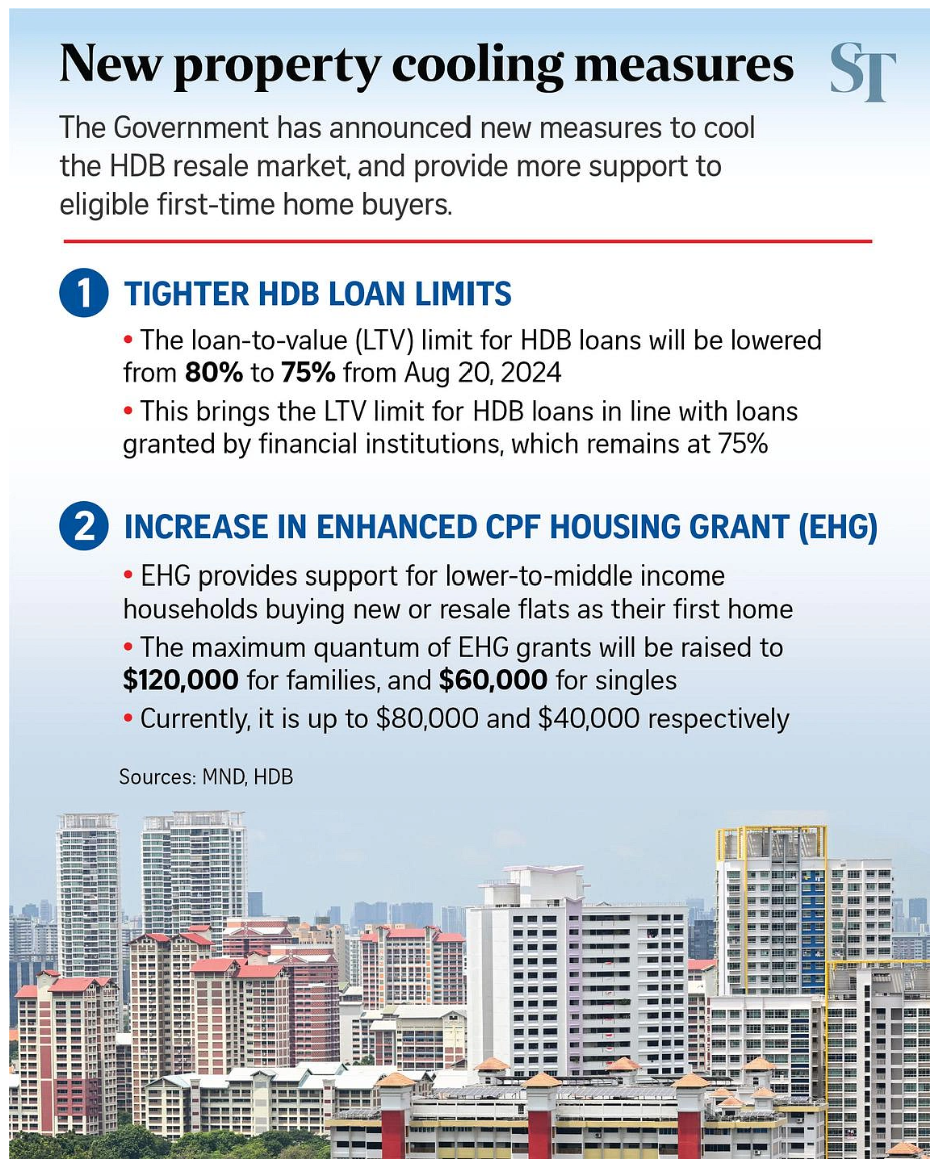

In August 2024, new private home sales in Singapore hit a historic low of 16 years.

This was due to developers delaying new launches during the Hungry Ghost month, while price-conscious buyers were also deterred by increased new launch prices, higher interest rates, and uncertain macroeconomic conditions. However, property analysts are hopeful for a revival of sales transactions in the upcoming months as mega new launches like Emerald of Katong (847 units) and The Chuan Park (916 units) are expected to be launched. Given that new launches has been above the $2000 psf price point and affordability becomes a concern for home buyers, there are buyers asking the question on whether they should bite the bullet and go into a new launch, or is there still value in the resale condo market. More specifically, a client asked about whether he should buy the Chuan Park or the surrounding resale condos.

To analyze this, I adopted the following methodology.

1. Look back into the top new launch condos that were launched in the past year. These includes

a. Lentor Mansion

b, Tembusu Grand

c. Lumina Grand (Executive Condominium) d. The Reserves Residences e. Grand Dunman

f. Continuum

2. Find the nearest condos to these new launch sites.

3. Check the growth rates for 3 different time periods.

i) 12 months prior to land bid was awarded

ii) Time from when land bid was awarded to actual developer launch date.

iii) Post launch period

Below is the result of the methodology utilized above.

Observations

1. When there is a new plot of land identified for new residential condo, the surrounding condos will stand to experience a 30% to 40% capital appreciation.

2. When compared to Total Singapore properties of similar tenure, resale freehold condos located beside the new launch performed much better vs resale 99 years condos.

3. For resale freehold condos, 90% of the capital gain comes from before the launch of the new condos. For resale 99 years condos, there is still some capital gain of about 10% to be captured post the new launch.

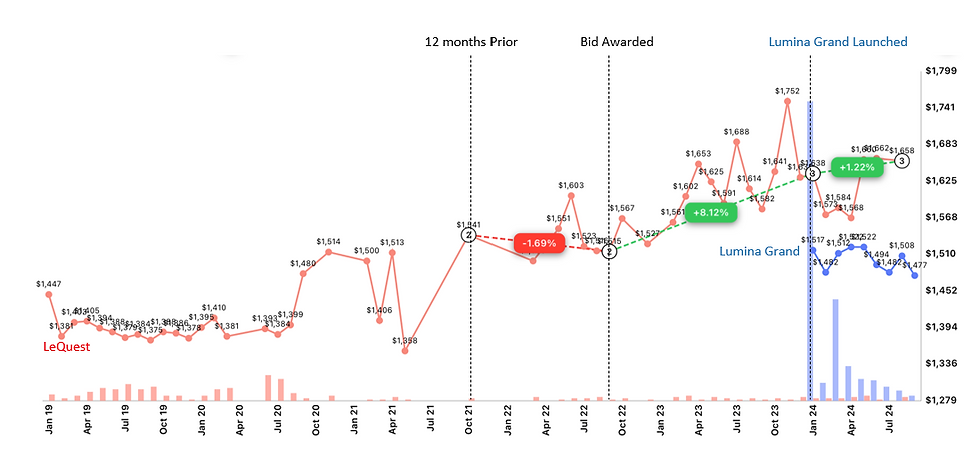

4. If the new launch is an executive condominium like in the case of Lumina Grand, the resale private condominium price growth is muted. This is probably due to the heavily subsidisied launch price of the executive condominum, causing buyers to be drawn to the EC. There will also be concerns that future sale prices of the EC will still be lower than the resale private condominiums.

The charts below were generated to tabulate the above findings.

Source of charts is from PropNex Investment Suites.

Lentor Mansion & Calrose

Continuum & 4 Condos - Ritz Regency, Imperial Heights, Emery Point, 38 I Suites

Lumina Grand & LeQuest

The Reserve Residence and Sherwood Towers

Grand Dunman & Waterbank At Dakota

Mapping the information with the above methodology, we can see that price movement has already began for the resale condos in the vicinity. Interestingly, Goldenhill Park Condo being the freehold condo nearest The Chuan Park has seen only a 25% increase prior to The Chuan Park's impending launch. This is unlike the case studies above where Calrose, Haig Court, and the 4 condos in front of the Continuum all saw close to 40% growth prior to the new launches. This might signify that there is still some potential value to be milked from Goldenhill Park Condo. This is especially so, when the current listing are still below the $2300psf price mark, when there is expectations that The Chuan Park might launch at above this $2300psf level. As for The Springbloom and The Scala, the former is the laggard here in terms of price growth, while The Scala has already achieve the 40% price growth that we have observed above in Observation 1. The Springbloom presents a lower risk opportunity in this sense, but its 99 year leasehold status puts it at a losing position versus Goldenhill Park Condo, which is of freehold status.

The Chuan Park, Goldenhill Park Condo, The Springbloom and The Scala

As the property market eagerly awaits the 2024 blockbusters launches to take flight, there might be pockets of opportunity in the resale market to capitalize on. It is always good to look back into historical performance to spot patterns as we embrace new opportunities in the future. Disclaimer: The above analysis is shared for educational purpose and is not to be taken as advice to buy or sell properties in Singapore. Hi, I am Wilson😄.

Leveraging on my experiences and passion in Real Estate Investing, I am on a mission to guide and empower 💯 individuals each year to embark on their journey🚀to building their property asset portfolios📈.

If you think I can help you, I am open to a non obligatory chat to share ideas.💡

Comments